In a world of rug pulls and misinformation we have our winners and losers.

Never thought we would encounter a licensed brokerage being pulled into this mess?; Without protections in place?

You must be looking for answers.

You might not find the answers here, but you sure will have the materials.

On June 27th 2022, Voyager secured strategic business advisors with Moelis & Company. They have 21 secured establishments in regions all-over the world. Following the close advisement of M&C, a chapter 11 bankruptcy proceeding was filed.

Source: https://www.prnewswire.com/news-releases/voyager-digital-provides-market-update-301575492.html

- The contagion of debtors and Creditors continues.-

There has been gross market manipulation happenings.

The strength in Voyagers utility token, has surpassed the hype/fud market action.

In short Tokenomics Theory: {Obiwan's Investment Criteria:}

[SIC]

Tokenomics - Usage (basic unit of account on the network, used for transactions, governance), Is supply capped?, If so what's the Consensus method (proof of work, stake) and emission type and schedule, How did it launch? Was it pre-mined/private sale?, Distribution (public vs. private), what's the vesting schedule for team and pre-sale, How much institutional influence?, Are the coins/tokens distributed to the few or the many?

Technology - Decentralization, distribution, security/consensus, scalability

Team

Liquidity - is this coin/token tradable on exchanges? What's the exchange supply/float? Is there trading volume and velocity?

Value - does this network/business have revenue? Real world problem solving?

Secondary- Utility/Use, Development and Community ... knowing your 'Why' and Time Preference are key when applying this criteria

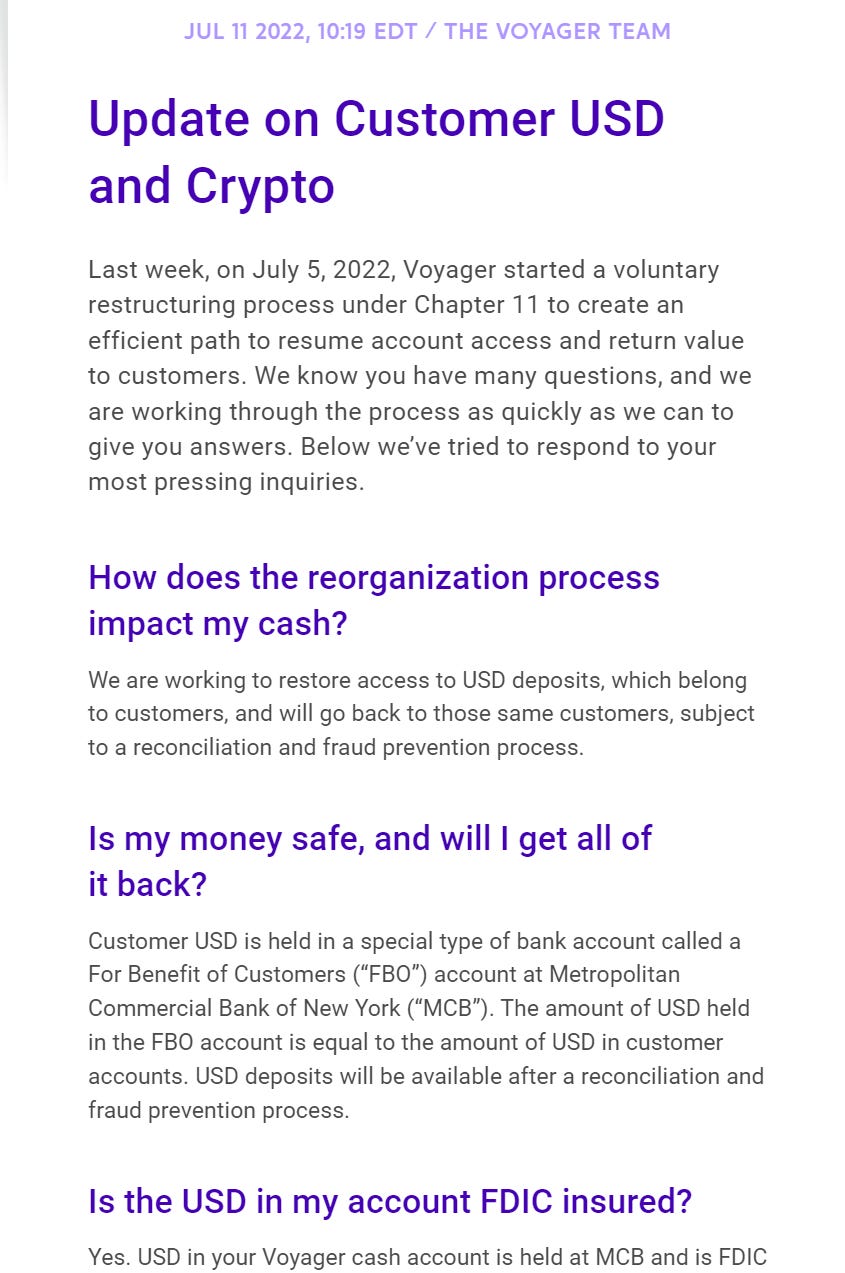

To continue business ops without further manipulations & avoiding potential party fraud; Voyager Digital took a leap of faith to file Chaper 11 (*Moratorium).

Filing Chapter 11, suspends operations to restructure its capital and continue on while paying down debts.

Reading Material on What Chapter 11 is:

People will take what narratives they want. Don’t let them flip them to hype their bags out of desperation.

Do not be their liquidity and do not start grabbing pitchforks yet.

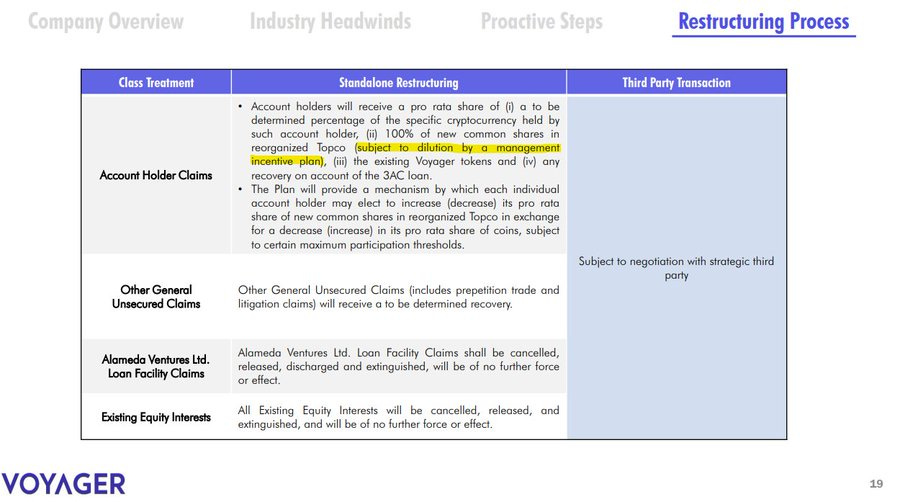

In this case, the incentive plan shown by a jaded former employee is not the full story shared. If there is a need to continue further chapters in bankruptcy proceedings the featured plan rules apply.

Full Proposed Plan: https://cases.stretto.com/public/x193/11753/PLEADINGS/1175307062280000000036.pdf

Voyager accumulated multiple companies along the way and transitioned to what is now known as VGX 2.0

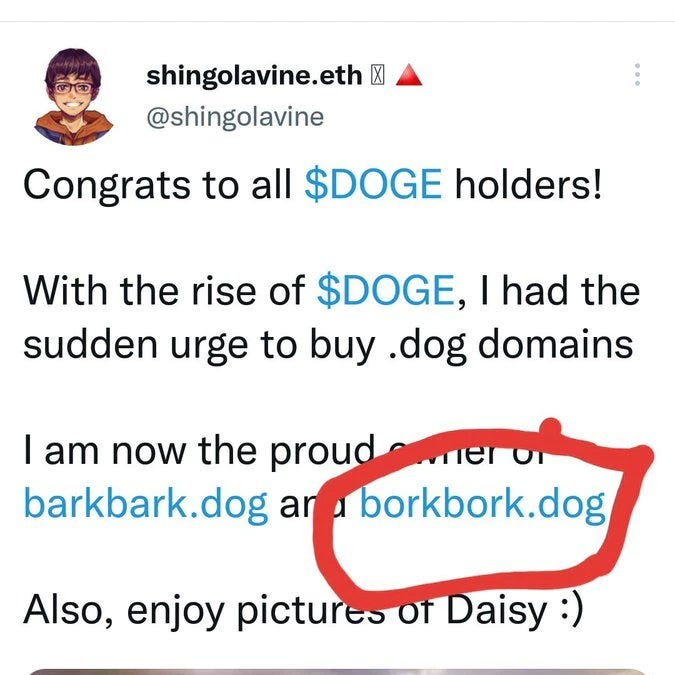

Previous Tokens of Ethos were given an opportunity for swap and has developed frenemies along the way; until no longer employed.

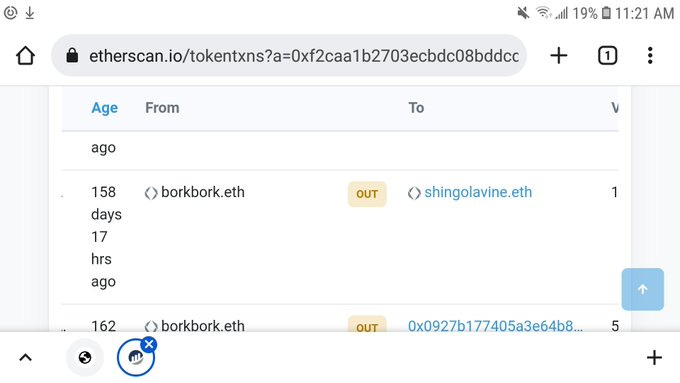

*Bork: To attack or defeat (a nominee or candidate for public office) unfairly through an organized campaign of harsh public criticism or vilification.

*Bork: Silicon Valley description when a project/tech craps itself.

In the news narratives, Sam Bankman-Fried was a savior of the Voyager platform. Voyager secured a loan from Alameda June 22nd 2022 with a credit limiting of $75mil cap.

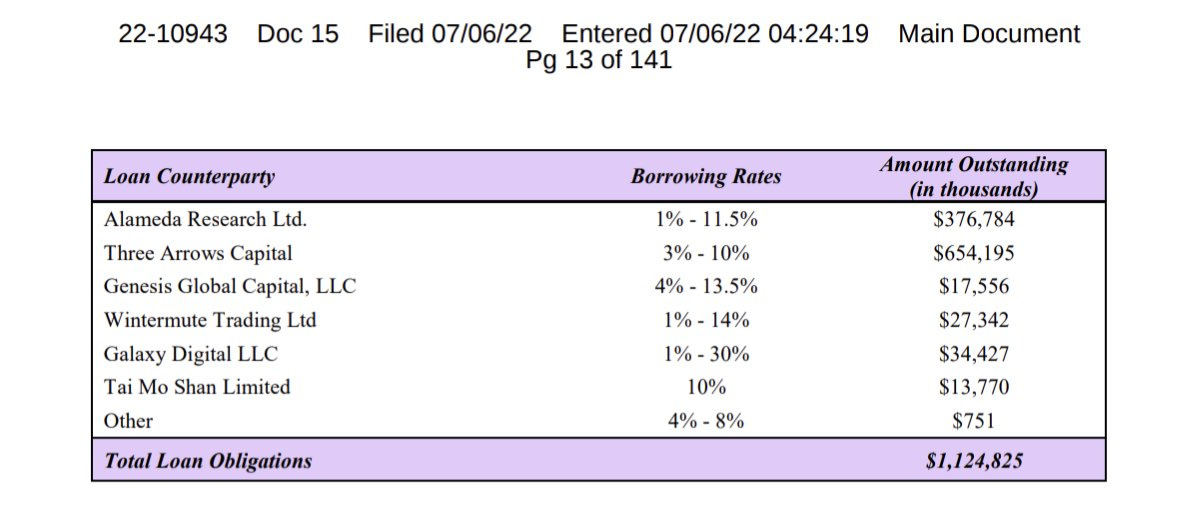

What We Have Learned from Public Court Case Dockets:

Voyager filing under Bankruptcy means Alameda loses $185M between stocks and loans. Given the market conditions, the collateral provided adds roughly 100+ more.

10. Filing a Chapter 11 bankruptcy case Chapter 11 allows debtors to reorganize or liquidate according to a plan. A plan is not effective unless the court confirms it. You may receive a copy of the plan and a disclosure statement telling you about the plan, and you may have the opportunity to vote on the plan. You will receive notice of the date of the confirmation hearing, and you may object to confirmation of the plan and attend the confirmation hearing. Unless a trustee is serving, the debtor will remain in possession of the property and may continue to operate its business.

11. Discharge of debts Confirmation of a chapter 11 plan may result in a discharge of debts, which may include all or part of your

debt. See 11 U.S.C. § 1141(d). A discharge means that creditors may never try to collect the debt from

the debtor except as provided in the plan. If you want to have a particular debt owed to you excepted from

the discharge and § 523(c) applies to your claim, you must start a judicial proceeding by filing a complaint

and paying the filing fee in the bankruptcy clerk’s office by the deadline.

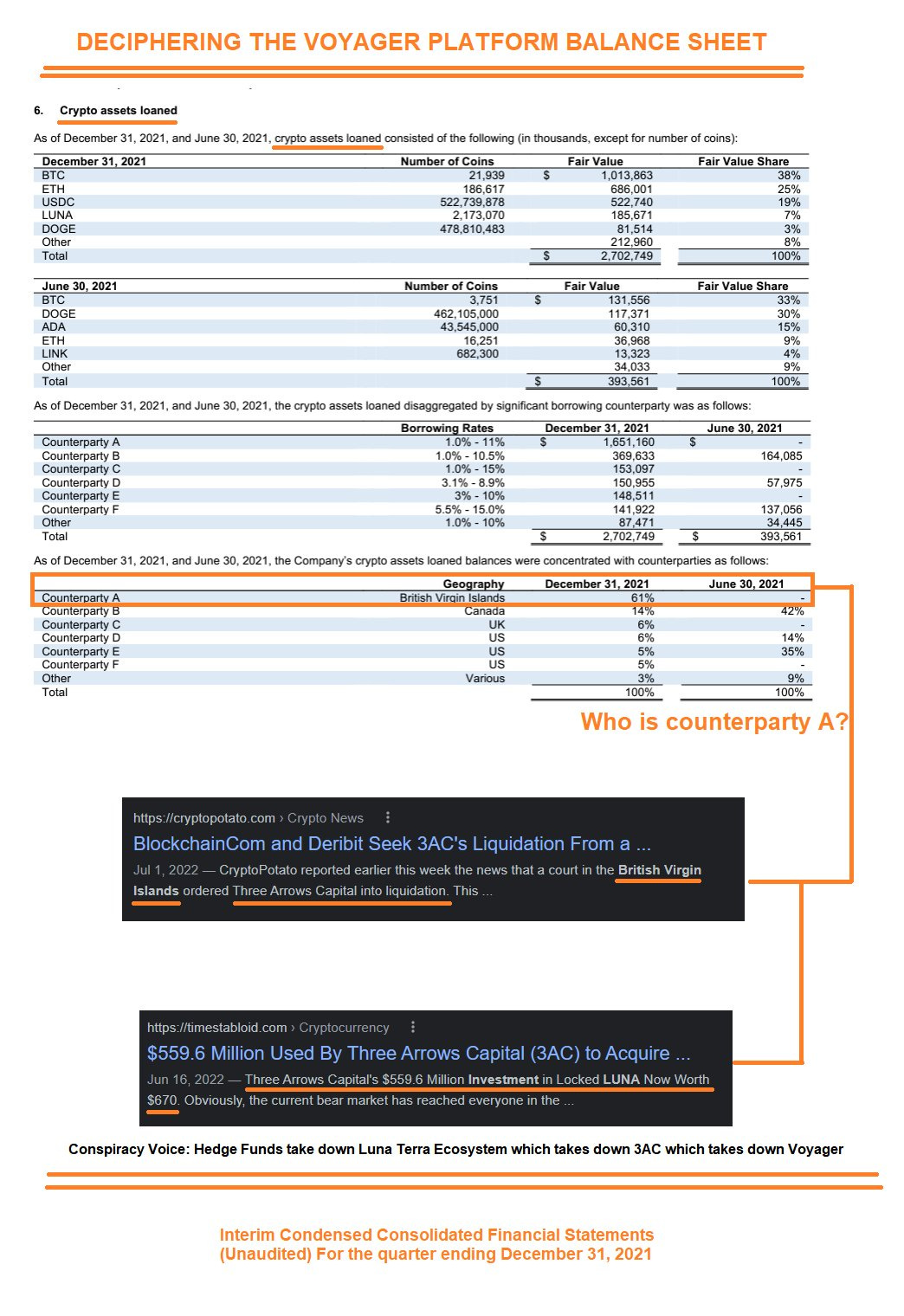

Luckily Alameda has reduced their debts to Voyager from 61% to 1-11% since June 30th 2021, but still hold a balance; Which gives them voting rights in the course of bankruptcy.

Audited Reports can be found in the SEDAR files for Oct. 28th 2021

Why would Voyager take a dump where they eat following legal business advisement and cordial share burns from party A?

----STILL NEED TO FINISH THIS SECTION.-----

Putting together my own speculation on prior deals and prospects that were interested and now under NDA until after August and following further court hearings.

If the debtors pay in full> business can continue as usual>

>Possible Bringing in a traditional banking brokerage to be completely FINRA compliant. (Needs to stay ahead of the game with state regulators)

>Destroy Lending

>What Equitity holders are getting nothing as of now but everything if they buy?

We won't know for a few months minimum based off the court processes but the company priorities is the platform functions to run as usual and employees, then customers.

There will be hair cuts. Overhead removal.

I calculated 4.60/share if bought and pulled into private stock for restructuring.

not quoting someones high evaluations {Voyager's high value was $2,326,476,152 so ~20% of that is $465M + $650M term is a best case buyout of $1,115M or $6.50 a share}

\

VGX is more valuable with VLP and would continue and grow over time.

We're on a crunch for time to ensure the success of the ch.11 filing strategy is going to Pull an Apple or a Kmart.

For the Sake of Digital Assets, I hope they survive. I have yet to of seen a crypto friendly company do more structuring for his customers than it has.Your investments are your own choices.

Interim SEDAR files: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00005648

{*Final Thoughts: Voyager, Alemeda, Galaxy, Blockfi, 3AC Celsius all loaned out loans to one another and someone failed. Continuing loans with volatile assets as collateral has drawbacks.}

Court Dockets Filed by Joshua Sussenberg of Kirckland & Ellis LLP on Behalf of Voyager Digital Holdings, INC | Voyager Digital LTD | Voyager Digital LLC

Direct Link: https://cases.stretto.com/voyager/court-docket/

TIPS APPRECIATED VIA STRIKEStrike is used to buy and sell bitcoin, get paid in bitcoin, tip on the web, send and receive micropayments, remit money, pay merchants for goods and services, and make payments with friends.