cRypTo 101: Crypto as is

Why does it matter if a “Digital Asset” is dubbed a security vs commodity?

If you asked the general population what crypto is you might find, “Its BitCoin”.

Crypto Assets, Digital Assets, Virtual Currency, Tokens, Coins, etc can be exhausting when misproportioned in current news outlets.

Even worse, we are trudging along the slope of securities vs commodities within regulating bodies (outdated) schools of thought.

Why does it matter if a “Digital Asset” is dubbed a security? Crypto needs defined clarity for associated regulatory treatments.

Full List of Crypto Asset Descriptions: Here

Examples of needed Clarity for regulatory treatments:

“What is legal is always moral but what is always moral is not always legal.” - Law and Ethics 101

If there is a glitch in the ethics to the narrative, do not become collateral damage.

Unfortunately, protections are in place for ‘Stock’ and NOT ‘Crypto’ at this time.

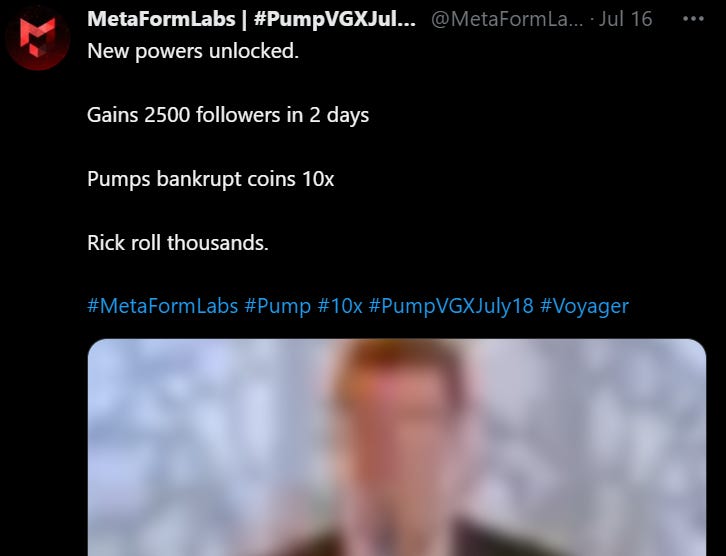

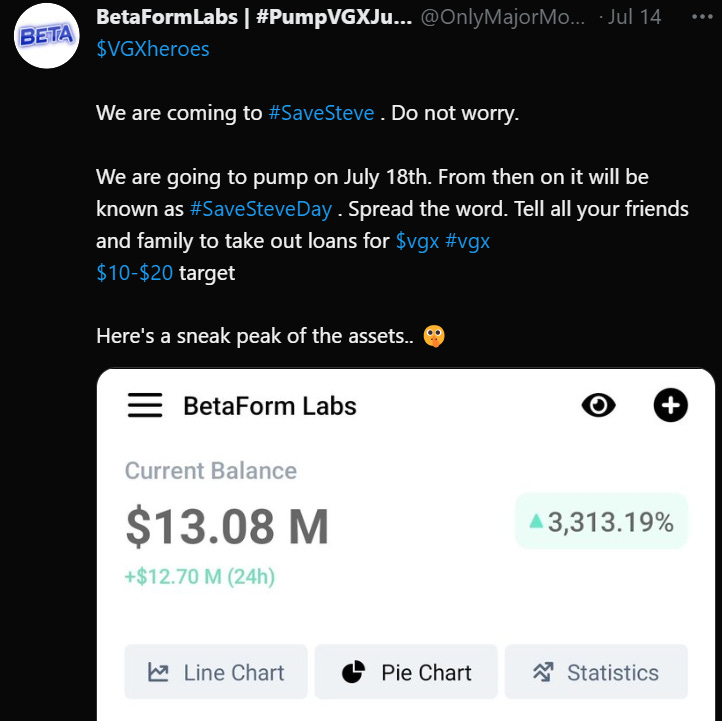

Pump and Dump Schemes

"Pump and dump" schemes have two parts. In the first, promoters try to boost the price of a stock with false or misleading statements about the company. Once the stock price has been pumped up, fraudsters move on to the second part, where they seek to profit by selling their own holdings of the stock, dumping shares into the market.

These schemes often occur on the Internet where it is common to see messages urging readers to buy a stock quickly. Often, the promoters will claim to have "inside" information about a development that will be positive for the stock. After these fraudsters dump their shares and stop hyping the stock, the price typically falls, and investors lose their money.

https://www.investor.gov/protect-your-investments/fraud/types-fraud/pump-and-dump-schemes

EXAMPLE(S) of delayed Protections by the SEC:

House Financial Services Committee's oversight hearing is this week on the SEC Enforcement Division.

SEC Slapdown Is A Wake-Up Call To Congress

“The defense argued that the agency failed repeatedly to provide guidance for years to anyone who asked it whether XRP was a security, and that the 2018 speech by then-Director of Corporation Finance William Hinman laid out criteria that strongly suggested XRP isn’t a security.”

Why does it seem like the world is burning around Degens?

The US has yet to create clear distinctions about how cryptocurrency is viewed compared to ordinary fiat and/or property transactions.

Cryptocurrency is taxed in the same way as property transactions in the US, and therefore operations involving it are deemed to be capital gains profits.

The SEC play a major role in overseeing cryptocurrency exchanges and token activities.

Securities, Commodities, Derivatives

***The Securities and Exchange Commission does not view Bitcoin and Ethereum as securities***

FAQ Resources:

What is a "Howey test"

https://sec.gov/corpfin/framework-investment-contract-analysis-digital-assets#_edn6…

SIFMA

https://sifma.org/resources/news/qa-digital-asset-securities/…

Where is the November 2020 SIFMA published whitepaper

A security token: Intended to be used the same way a stock, bond, certificate, or other assets are used. Represents rights of ownership, transfer of value, or promise of returns that are tokenized on a blockchain. It is intended to be treated as an investment instrument

A Crypto Commodity: (Owning commodities in a broader portfolio is encouraged as a hedge against inflation.) Prices determined by supply and demand A fungible asset that may represent a commodity, utility, or a contract in the real- or virtual-world through exclusive tokens.

Derivative (Security): Is a financial security with a value that is reliant upon or derived from an underlying asset or group. (Contract between two or more parties to lock in specific rates of exchange.)

Understanding Brokerage Windows in

Self-Directed Retirement Plan

https://sifma.org/wp-content/uploads/2022/06/SIFMA-and-Joint-Trades-on-DOL-Crypto.pdf… April 12, 2022

https://dol.gov/sites/dolgov/files/EBSA/about-ebsa/about-us/erisa-advisory-council/2021-understanding-brokerage-windows-in-self-directed-retirement-plans.pdf… December 2021

TIPS APPRECIATED VIA STRIKEStrike is used to buy and sell bitcoin, get paid in bitcoin, tip on the web, send and receive micropayments, remit money, pay merchants for goods and services, and make payments with friends.To be Covered on a Later DateFINRA

FINCEN: National Regulatory Bureau (USA)

-Foreign exchange services,-Background checks,-Money transfers,-Sales with prepaid access.MBS

Licenses

-Fiat Cryptocurrency Exchanges: Fiat currency for crypto and vice versa. Specializd and complex business models. (Licensing More Stringent)-Traditional Cryptocurrency Exchanges: Crypto to Crypto Trades. Users are only able to trade one crypto for another, but cannot directly exchange fiat currency for crypto. (Licensing is less Stringent)State Regulatory

Politics

Brokerages

Loans

SIPC

FDIC